The Learning Technology market is big. Every company is onboarding, reskilling, and developing its people and companies need dozens of tools to do this well. In fact, the entire learning tech market is now over $4 Billion in size and it continues to be one of the most dynamic technology markets in the world.

And now it’s getting even hotter. Not only do companies buy learning tools to train and upskill employees, but many companies also sell learning as a product. In fact, for whatever product you sell there is likely an opportunity to sell training that helps make your product more useful, helpful, or valuable. When I worked at IBM in the 1980s we called that “clothing the sale” in services and education; today, companies that sell education as a product generate high-margin revenue streams.

Let me give you a few examples. Amazon’s web services business, which is more than $20 Billion in size, now offers an entire academy of training for AWS’s customers. L’Oreal, which is one of the largest providers of beauty and hair care products, sells millions of dollars of training to hair care specialists. Hundreds of other companies do the same. And every tech company from Oracle to Microsoft makes hundreds of millions of dollars selling certifications, credentials, and ongoing education to drive usage.

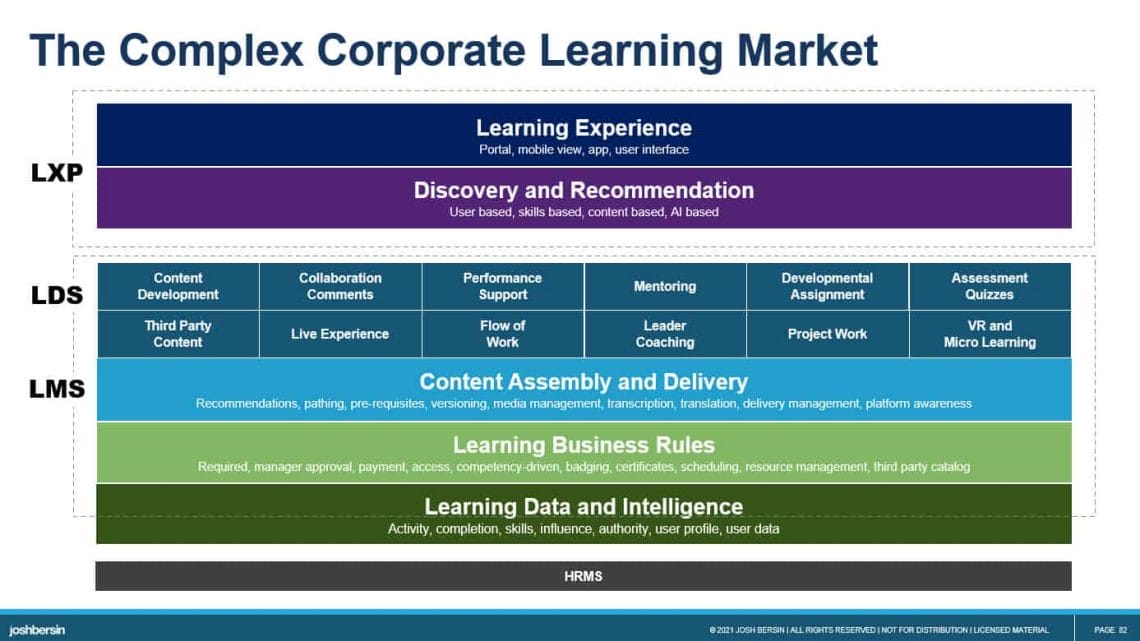

How do they build and deploy these solutions? For internal training solutions, companies need a core learning management system (LMS) and often buy a learning experience platform (LXP), a series of development tools, and systems for assessment, collaboration, and analytics (LDS or Learning Delivery System). And these tools command premium prices. Vendors like Degreed, BetterUp, EdCast, and LinkedIn command billion-dollar valuations driven by this growth.

In some ways, this market is quite mature. Vendors like Saba (the pioneer), Plateau (fast follower), SumTotal (conglomerate), and hundreds of others have been acquired. Today the big players (Cornerstone, SAP, SkillSoft, and now Workday) have integrated these platforms into complex talent management systems, drifting away from this newly emerging learning market. And this, of course, lets new vendors reinvent the space.

Enter Docebo.

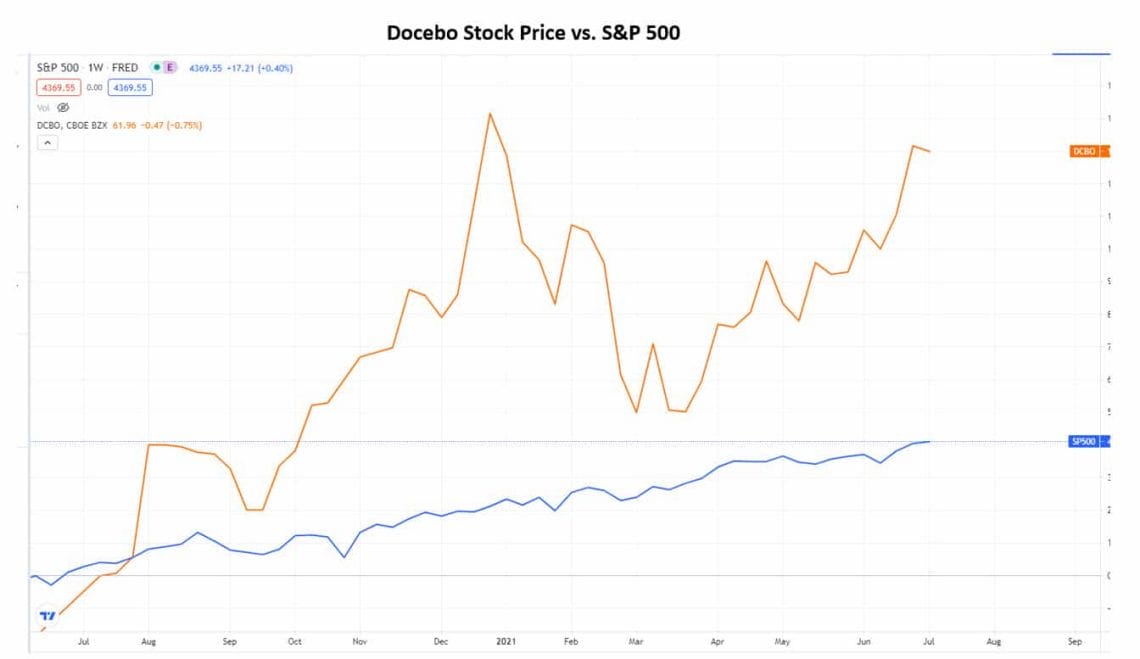

Docebo, which was founded in 2005, is walking away with a large percentage of this market. With more than 2,300 customers and a growth rate of over 60% year over year in Q1, this is an $80 Million recurring revenue company now valued at $2 Billion that could become the market leader. Cornerstone, the current leader, is roughly twice the size in recurring revenue, but Docebo is growing at four times its rate.

Why? What has Docebo done to take on such a leadership role?

Well, it’s an interesting story, and let me start by explaining something important. The LMS market has been around a long time, and most of the older vendors built products that focused on administration, compliance, and the complex business processes in learning. Saba and Plateau, for example, spent years building compliance software, and are now deeply embedded in pharmaceutical companies, financial firms, and tax and accounting firms for their ongoing compliance needs. In their early days these companies competed heavily for this business, so their systems were designed as “ERP-like” applications.

Since then, the world has moved to video-based learning, AI-enabled recommendations, micro-learning, and learning as a product or offering. Since these incumbents focused on other talent management features (recruiting, performance management, compensation), they just didn’t see this coming. So Docebo, which remains 100% focused on the needs of the learning team, built a more compelling solution.

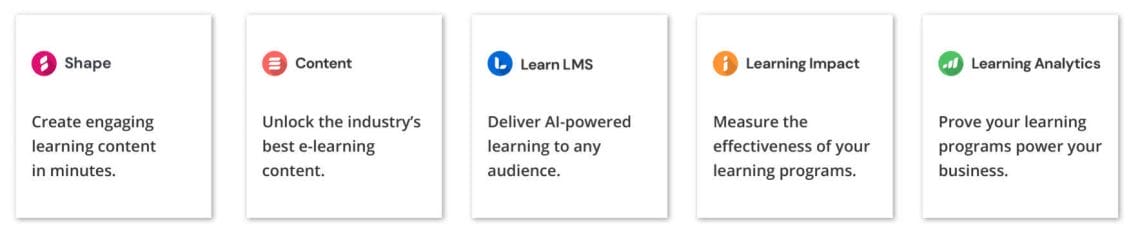

Today, Docebo positions itself as a Learning Suite (or what I call a Creator Platform for Corporate Learning). Unlike an LMS that “hosts courseware you developed elsewhere,” Docebo is a complete solution. You can build a learning community, author and manage content, and analyze and measure its impact. Plus you can create product offerings, certifications, and many forms of revenue-generating products from its integrated, easy-to-use platform.

Not only that, but the product and company can scale. Enterprise companies like Amazon Web Services (AWS), L’Oreal, Walmart, Thomson Reuters, and many others use the system, and the total user count is in the millions. The system is built on extensive AI that now includes tools for video production and integrated collaboration, as well as and has lots many features for e-commerce and product bundling.

The Suite is here at the right time. Right now it’s kind of dizzying to build online learning content: there are hundreds of tools (Articulate Global, one of the leading tools companies, just raised over $1 Billion in cash, for example), so training and HR managers have to figure it all out. Tools for video authoring, translation, text analytics, and collaboration are often “bolted together” from various products, making the learning department into a systems integrator. While that’s the way the market works, Docebo makes this much easier.

And I don’t see this slowing down. As I look at the LMS and learning platform market, I see a total reinvention taking place. While the LXP market has been at the forefront, those players are now well established (Degreed, EdCast, Microsoft Viva, LinkedIn) and it’s time for the core learning market to grow again. Vendors like Oracle, SAP, and Workday are building features as fast as they can, so focused vendors like Docebo can do quite well.

There are other great learning platforms also – offerings like Totara (LMS), 360Learning (collaborative learning), Fuse Universal (video-centric), NovoEd (leader-led collaborative learning), Intrepid, and many more (Wisetail, EdCast LMS, Learnupon, and others). And the emergence of Creator Platforms for Learning is explosive.

But Docebo, with its integrated solution and experience with enterprise customers, is clearly coming out ahead. And for revenue-generating learning, Docebo is clearly the one to watch.